ICv2 2016 Survey: The Market Grows Again

July 19, 2017 by redben

It’s an exciting time of year for industry watchers, as ICv2 has just released the latest issue of their Internal Correspondence magazine. This one is the second of the two which are usually published each year. It puts some meat on the bones of the survey of the North American tabletop market in the previous year, as well as updating the sales charts for products sold via hobby stores.

The survey covers companies, distributors, stores, public accounts, and crowd funding figures, to estimate the size of the tabletop gaming market in North America. ICv2 have been able to track the astonishing year-on-year growth of tabletop gaming since 2008 through this survey and track trends within the industry also. Although it includes mass market sales, it excludes mass market, ‘non-hobby’ games such as Monopoly and Scrabble.

The headline is that the market growth shows no sign of slowing down, with the consistent growth of around 20% per year being maintained in 2016. ICv2 estimated growth of 21% last year, bringing the overall estimated value of the market up to $1.44 billion.

Collectable games remain by far the biggest sellers and account for a little over half that total. Magic remains the king of the hobby market, though the year belonged to Pokémon, which capitalised on its 20th anniversary and the success of Pokémon Go to have a storming year, blowing past Yu-Gi-Oh! to take second place on the back of sales which may even have exceeded the height of the Pokémon boom of the late-90s.

The new kid on the collectable block is FFG’s Star Wars: Destiny, which has quickly established itself as the number four collectable game. Destiny has been plagued with supply issues, with the first set, in particular, being very difficult to find. Even the second set, which had a much bigger print run, was still being sold as fast as it was coming into stock.

Our very own Dawn had to buy some whilst at Expo, so difficult has it been to find in the US. As ICv2 don’t break down revenue by game, it’s tough to know just how far behind the big three that Destiny is, and whether if supply had been able to meet demand, it would have been a threat to them.

There’s growth in every category, with the fastest growing market being role-playing games, though this should be tempered by the fact it is also by far the smallest category, accounting for just $45 million. D&D had a strong year and put more daylight between it and its nearest competitors.

Non-collectable card and dice games were the next biggest area of growth, not least because of growing sales in mass market channels. Cards Against Humanity remains popular, and Codenames has established itself as a consistent big seller.

The hobby board game market has tripled in size in just the last three years and has now left miniature gaming in its dust as the second biggest revenue generator. Although, at $305 million, it’s still less than half the revenue generated by collectable games.

After plateauing in 2014 at $125 million, miniature gaming has had a strong couple of years to break the $200 million barrier for the first time in 2016. However, it is the slowest growing area of the market at 17% last year.

A note of caution is sounded by ICv2, who note that whilst the market is continuing to grow, the pace of new releases is now outstripping this growth. It is leading to hobby stores seeing shorter and shorter shelf-lives for new games, with even evergreen sellers starting to suffer, though ICv2 do speculate that evergreens may be transitioning more of their sales to mass market channels.

The new issue of Internal Correspondence also gives the top sellers charts for Spring 2017. Whilst the survey covers all revenue generated by hobby games in North America, it’s important to note that these charts are only for sales in hobby stores. They exclude all sales in mass market channels, speciality stores (such as video game stores), and all direct sales.

It should come as no surprise to find that Magic, Pokémon, Yu-Gi-Oh!, and Star Wars: Destiny are the top selling collectable games. Nor that D&D is the top selling RPG. Moving on.

The hobby board game market seems to belong to Scythe, who in addition to picking up a swathe of awards has improved from #2 at the end of last year to take the top spot in 2017. Designer, Jamey Stegmaier recently announced that the game had gone past 100,000 sales. Bear in mind this is a game which had almost 18,000 backers on Kickstarter before even making it to retail.

Alessio Cavatore’s Labyrinth is proving to be a big success and holds the #4 spot. Kennerspiel des Jahres finalist, Terraforming Mars, has sorted out some of its supply issues to crack the top 10 for the first time at #7.

Another game held back by supply issues was Arkham Horror: The Card Game, though it still jumped straight to #4 on the non-collectable card and dice chart upon its release late last year. Whilst it has by no means solved those issues, greater availability has seen it take the #1 spot, the only one of FFG’s living card games to make the top ten.

ICv2 do note that Codenames, which has been knocked down to #2, would still be #1 if mass market sales were included. With Marvel and Disney reskins and a two-player version on the horizon, the future looks very bright for Codenames.

X-Wing retains the top spot over 40K in miniature games chart. This is probably the most misleading chart as since X-Wing took #1 around the time The Force Awakens was released, it has led some people to believe it’s now the biggest selling minis game. As a significant amount of 40K sales are excluded due to the chart only reflecting sales in North American hobby stores, 40K is still likely the biggest seller once all sales are taken into account.

Jumping straight in at #3 is Nolzur’s Marvelous Miniatures, a line of unpainted D&D minis from WizKids. Star Wars: Armada has made its way back into the top 5 after having dropped out last time. FFG did release a campaign earlier this year which has revived interest in Armada in my local area, so it wouldn’t surprise me if this is the reason for its resurgence.

Warmachine has found itself pushed down from #3 to #5 as a result, and the two lines which drop out are Age of Sigmar and Hordes.

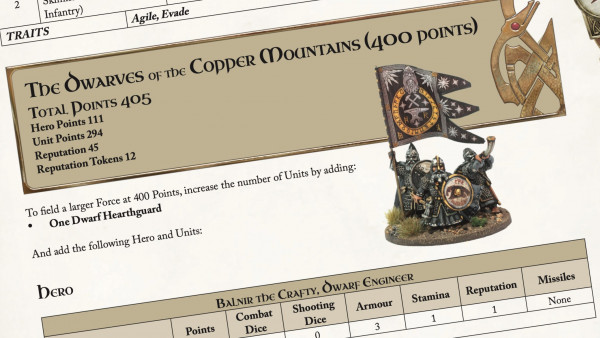

Malifaux and Infinity are unsurprisingly noted as lines doing well outside the top 5, though more surprising is Knight Models’ DC lines, as these seem to have struggled to get adequate distribution in North America. One line not performing as well as expected is RuneWars, which has struggled on release. It may be that FFG are discovering why GW got out of the rank & file business, although with only two playable armies at this point there’s still time for the game to turn things around.

I’ll finish with some thoughts on where these figures indicate the industry might be going. As tabletop gaming sales increase in mass channels, which favour lower price point products that are easy to pick up and play such as Codenames, Catan, and Cards Against Humanity, and a glut of new releases fight for shelf-space in hobby stores, the market seems like it will be less and less favourable to ‘long tail’ product lines which require ongoing sales from ongoing releases (and the shelf space to match), which makes the miniature game industry less competitive against card and board games.

Even games such as RuneWars and A Song of Ice & Fire, which are packaged as board games with pre-assembled plastics, will still require a lot of shelf space to keep the multiple armies in stock which are necessary to keep the game playable for a local scene.

When these games are fighting against the latest big box board game releases, which need less shelf-space and can survive on a shorter shelf life, and consumers are increasingly burning through new releases to keep up with the market, then it wouldn’t surprise me to see more and more miniature games from larger companies migrate to a self-contained big box format.

What are your thoughts on this growth in the industry?

"...the market seems like it will be less and less favourable to ‘long tail’ product lines which require ongoing sales from ongoing releases (and the shelf space to match), which makes the miniature game industry less competitive against card and board games."

Supported by (Turn Off)

Supported by (Turn Off)

Supported by (Turn Off)

Very interesting stuff… it is a tough to potentially get a sense of where some games are going when only looking at a few sources of sales… I wonder about a lot of ‘new gamers’ that have picked up stuff @ big box stores or amazon.com and don’t venture into their gaming stores. One thing not mentioned (this year? can’t recall if it was talked about last year) is the discount market effect on this stuff… and how that affects both sales @ brick & mortar sales but also does increase sales potentially. The one thing I have noticed more… Read more »

Whilst the charts are sales in hobby stores, the survey does cover mass channels. The sales in those types of stores tend to be evergreen board and card games. I don’t see smaller scale models replacing 28-35mm as the long-term trend of the market suggests those scales are very niche and don’t have the appeal of larger models. I exclude from that games which use smaller scales to allow battles with large models (such as Dropfleet Commander). The space needed for miniature wargames is an issue for stores wanting to run tournaments, albeit not an unsurmountable one, but the space… Read more »

Some of us have never left 6 or 10mm though we still the same sized 8×4 tables to play the games on

I’m not suggesting there people don’t play at those scales, I know some myself, but the revenue those lines generate suggest it’s a niche market.

I do realise that. I think people who consider the smaller scales do it to reduce table size etc To me I do it because I think it look great on the table and to get a sense of units looking like units.

Indeed. They’re great for showing off a full battle.

Nice article @redben I think you’re probably right about miniatures games moving to a self contained big box format and that’s definitely the trend on Kickstarter. I do think, however I think we will still see a pool of more traditional miniatures games continue for some time – although I predict it will get smaller and those games may well be linked very strongly to the IPs of self contained game boxes such as Mantic have done with Dungeon Saga and Kings of War (and about to do with Warpath, Deadzone and Star Saga). From a personal perspective I have… Read more »

I do hope that gaming (referring to historical miniature wargames and rules) doesn’t lose that independent feel to it with small companies producing interesting ranges and rules. There is nothing better than trawling through websites and and traders at shows. They have been the bread and butter of the hobby for many years now and long may they continue

I think that small, independent nature of those types of companies insulates them from any great changes in the industry. They aren’t fighting for shelf space or needing to shift thousands of copies.

True I remember Peter at Bacchus apologising that after 20 years of trading he had to finally register for a VAT number and put his prices up

Baccus even. Stupid auto correct

I was about to echo @redben on this. I think historical is kind of protected from some of the pressures of wargaming industry because it is mostly small independent companies usually producing rules OR miniatures.

I think Warlord and Battlefront will end up going into the more mainstream end of wargaming and games like Bolt Action and Flames or War will be competing against the likes of 40k – hell I considered Bolt Action as an alternative to 40k!

What have never really understood is why I f most of the historical companies are small scale why the prices are so much cheaper than fantasy and SciFi. Fir example I am sure the Perry’s pay as much for tooling their plastic 28mm figures as other companies but retail at a fraction of price of their fantasy and SciFi counterparts

Oops forgot a bit,……even for metal ranges you would hard pressed to find a figure selling for more than £1.50 for 28mm

There’s a couple of different reasons for it. One of them is what you need the income for. The Perrys basically only need to cover their tooling costs, as they sculpt everything themselves in their spare time (effectively for free), have no employees and no premises. They also sell their metals direct (or via Dave at shows). As do Foundry and a lot of other historical minis companies. If you send your full range into distribution then you need to mark-up twice, once for the distributor and once for the store. Your direct sales have to match that price as… Read more »

“X-Wing retains the top spot over 40K in miniature games chart. This is probably the most misleading chart as since X-Wing took #1 around the time The Force Awakens was released, it has led some people to believe it’s now the biggest selling minis game. As a significant amount of 40K sales are excluded due to the chart only reflecting sales in North American hobby stores, 40K is still likely the biggest seller once all sales are taken into account.” I would like to challenge this a bit. X-Wing in 2018 will have a True Worlds Championship as they are… Read more »

ICV2 only reports on North America Hobby And Gaming store sales which is the context framing this article; sales direct from manufacturer are excluded and most of GWs north America sales are direct.

But GW are popular in many markets outside of the UK, including Australia, USA, Canada and the EU. They also have a far East presence as well.

Challenge accepted lol Well over a third of GW’s North American revenue is derived from their stores, whereas FFG sell very little direct. North America is FFG’s biggest market, whilst the UK is almost as big as North America for GW. Those two things alone would have to mean X-Wing not only outsells 40K in North American hobby stores, but that it outsells it by a huge amount. The proof of the differential can easily be found in the financials. We know that FFG’s annual revenue in 2013/14 was $40.6 million. GW’s announce their latest report next week (stay tuned)… Read more »

I’ll add to this, as I usually do when this comes up, that X-Wing toppling 40K in North American hobby stores stands on its own as a massive achievement. 40K was so far in front when X-Wing launched that it would have been hard to conceive of it happening a few years later.

In regards to miniatures versus other games, it has been two past weekenders where the boys have discussed that board games are easier to hit the table. If you play miniatures games you need others who also have that game and a lot of terrain space. Unless, everything you need is in one box. A reason why I believe that Mythic Battles: Pantheon has such great appeal — All in one box. Something I hope we see with Joan of Arch as well. Guild Ball is approachable in the same way.

All good trends IMHO

The guys at Steamforged are very switched on. I wasn’t surprised to see them in the forefront of minis games repackaging themselves as board games.