Home › Forums › News, Rumours & General Discussion › Brexit realities in the hobby Industry!

This topic contains 47 replies, has 24 voices, and was last updated by ![]() yoshi 4 years, 1 month ago.

yoshi 4 years, 1 month ago.

-

AuthorPosts

-

January 9, 2021 at 12:25 pm #1595497

Hello Folks,

Im just looking for a bit of clarification on the current realities of ordering hobby related products from the UK while being based in Europe! I’m based in Ireland and from what I can decipher in the media my understanding of things is as follows;

Only goods bought from the UK that are of UK or EU origin will avoid tariffs under the Free Trade Agreement in place. Otherwise anything over €22 (including postage) will see the addition of an extra Irish VAT charge and anything over €150 will be subject to further Custom charges!

My belief is nothing changes with hobby suppliers such as for example, Mierce miniatures and other independent producers who create their products within the UK, but how will this affect the likes of Wayland and OnTableTop? Right now i’m looking to order Infinity Code one and Star Wars Armada Clone war sets from Wayland. My total adds up to well over €150, I know Infinity originates in Spain so is covered by the EU rule but what about Star award Armada? What classification does a product like this fall under? Same goes for GW products some of which I presume are produced in China! Anyone have any ideas or knowledge from a recent order etc? I know it’s early days in the whole process but hoping someone in the community might have some insight. Hobby products can be expensive as it is without the horror of unexpected custom fees being added!!!

Regards to all and stay safe.

January 9, 2021 at 12:36 pm #1595498I’ve been wondering something similar. I moved to the Netherlands recently. Doesn’t OnTableTop get some sort of exception for being based in NI?

January 9, 2021 at 1:05 pm #1595499The rules of origin for the UK EU Trade agreement are very complex. Just because a factory makes something in the UK , doesn’t automatically mean it is made in the UK as far as these rules are concerned! The rules vary for different types of product, but for most the rule is that at least 50% of the value of the components must have come from the UK. So a manufacturer casting plastic or metal where the plastic or metal came from the UK are likely to be ok, but if the plastic or metal is imported before being cast, the product may not count as being made in the UK. Model companies could also fall foul if they are getting the models cast en-masse in China or similar.

I work for a company that manufactures electrical goods in England and have been trying to figure out exactly how shipping to the EU will work all week. Most people I’ve tried to get answers out of (e.g. the trade experts at my local Chamber of Commerce) haven’t been able to help me.

Shipping to and from Northern Ireland is a different problem. NI to and from the rest of the UK has a whole extra level of crazy, though NI to the EU I believe is as it used to be. I could be wrong though. Being based in England it is not something I’ve had to dig into.

January 9, 2021 at 2:39 pm #1595523I’ve seen both Warlord and GW say that they’ll take care of VAT & Customs so we probably will see some price changes in the future.

I do wonder what it is going to be like for small webshops and manufacturers, because I suspect the actual rules are as clear as mud for everyone on both sides of the border.

And don’t forget that this Covid-thing makes matters even more complicated (shipping costs for containers appear to have doubled due to shortages in shipping containers …)

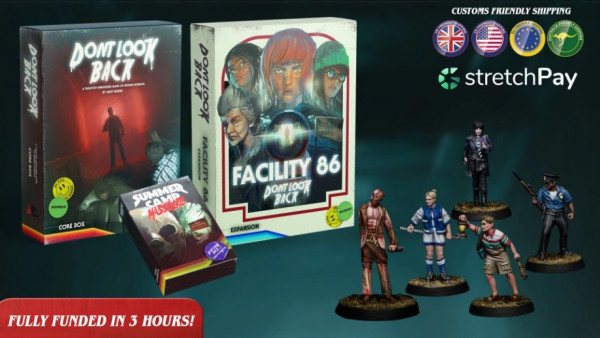

The OTT Store did post this update :

January 9, 2021 at 3:37 pm #1595527If OTT is now owned by Wayland and Wayland is based and probably VAT registered in England do the goods count as being VAT deducted at point of sale as and thus our EU colleagues having to pay VAT on arrival of the goods? Or do they count as coming from NI and thus everything carries on as before?

Its all very confusing

January 9, 2021 at 4:57 pm #1595549It’s really telling how badly whole thing has been handled when there UK has no trade agreement with EU after all time it took and everything is so unclear.

January 9, 2021 at 9:53 pm #1595610January 10, 2021 at 7:43 am #1595642Sounds like the only solution is to buy from a retail outlet in your own country.

January 10, 2021 at 3:10 pm #1595819Normally I’d agree but with tabletop it’s hard finding another site that offers not only the same amount of games but also a similar discount.

January 10, 2021 at 3:43 pm #1595820If you’re going to get import charges due to UK leaving europe then any discounts are negated.

January 10, 2021 at 3:48 pm #1595821If OTT is now owned by Wayland and Wayland is based and probably VAT registered in England do the goods count as being VAT deducted at point of sale as and thus our EU colleagues having to pay VAT on arrival of the goods? Or do they count as coming from NI and thus everything carries on as before?

Its all very confusing

@torros I agree. Maybe someone from Wayland and/or OTT (@warzan @lloyd ) could chime in? Or make a post that will clear things up?

January 10, 2021 at 3:55 pm #1595822I imagine no one has a clue as the government hasn’t got one, but the VAT registration is secondary as far coming from NI goes as anything that is imported with a view to export has separate duties to pay on it.

My suggestion is to send your local MP a shit in a box, and if you aren’t from the UK then feel free to post a turd to Boris Johnson at number 10 Downing Street

January 10, 2021 at 4:05 pm #1595823Posting stuff to the UK got very expensive! Not shipping shit at those rates…. XD

January 10, 2021 at 9:48 pm #1595979Thanks for the discussion folks and the further insight. Reading into it a bit more through national newspapers it also appears that if a product is produced in the EU then brought into the UK but repackaged in anyway it seems that product then loses its EU origin status and will be subject to vat/customs if exported to other countries! This mainly applies to food produce and larger chains ie Tesco/M&S repackaging to include their own brand name on items but it’s a further level of complication on top of the issues @danlee mentions and may impact on our hobby in some manner.

The general sentiment I feel is that there is no clarity for individuals or business no matter the type of product!

@pagan8th while I do shop as local as possible when I can, product availability, limited range options are just some of the issue that present restrictions on local purchasing. Pricing is a big factor too, online stores such as OnTableTop and Wayland offer discounts on products that genuinely lead to big savings which in my case helps with justifying some hobby expenditure in conjunction with supporting a family. From my rather basic understanding of the new EU/UK trade agreement is that not all products related to our hobby will be subject to further import charges so discounts and savings are potentially still to be had with suppliers like OnTableTop and Wayland. I’m just in the dark as to which category certain products fall into. For example Infinity products I believe are produced within the EU so are protected from further charges or fees if purchased from a UK supplier and shipped to Europe. Products produced within the UK meeting the standards as outlined by @danlee are similarly protected. However my confusion starts with products for example produced by FFG such as Star Wars Armada! Which category do they fall within? Am I going to be subject to custom fees/extra Vat on these products if ordered from a UK supplier? Are the Custom declarations or invoices going to be worded clearly and correctly enough to protect a customer from local Revenue officers if a package is checked?

I know the world is a mess at the moment and there is bigger issues in life and it’s probably a case that folk in the industry just don’t even know themselves but I suppose I was just a bit impatient for a bit of clarity! No doubt these issues will eventually iron themselves and hopefully it will be in favour of our hobby.

Take care all and stay safe.

January 11, 2021 at 1:39 am #1596016As someone who has always lived outside these trade zones and deals what normally happens is someone like Perry or Warlord deduct the VAT for us. In Australia GST (10%) get charged on certain imports but none effect what us Hobbyists will order

-

AuthorPosts

You must be logged in to reply to this topic.